Acknowledging that Europe is “98 per cent” dependent on China for critical minerals in the process of clean-energy transitioning, she also underscored the European Union’s divergence from the US’s approach on trade with China.

What are rare earths used for?

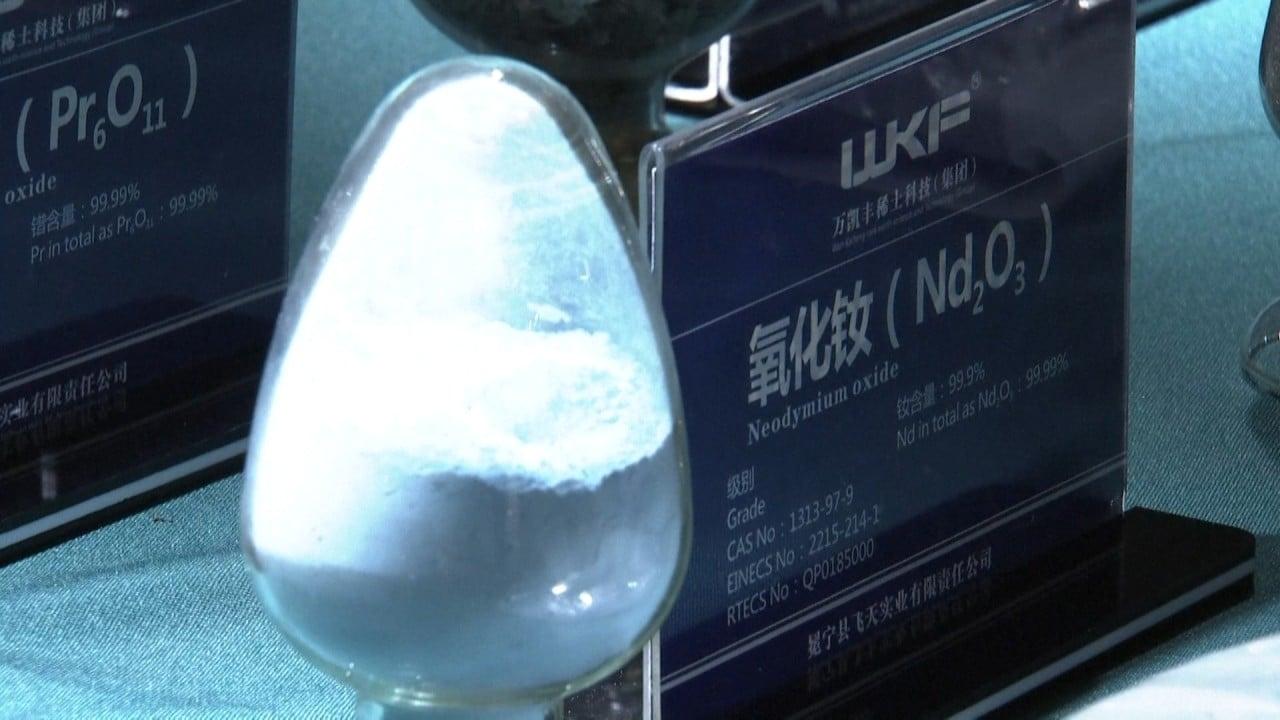

Francoise Nicolas, director of the French Institute of International Relations’ Centre for Asian Studies, explained how rare earths are “essential” minerals for making electric cars and wind turbines, and that the European Union remains heavily reliant on imports from China.

In addition to its applications in clean-energy developments, rare earths also contain critical elements used in defence equipment.

A US military advocacy publication, Air & Space Forces Magazine, notes how rare earth elements are widely used in magnets for missile guidance; disk-drive motors installed in aircraft and tanks; satellite communications and radar systems.

“These elements used to come from the United States,” the publication says. “From the 1960s to the 1980s, the US was the global leader in rare earth mining and production. That is no longer the case.”

Why are rare earth minerals so critical?

The International Energy Agency expects that it will require six times more mineral inputs in 2040, relative to today, as countries race to meet their targets of net zero emissions by 2050.

Patrik Andersson, an analyst at the Swedish National China Centre, noted how the mining of rare earth minerals is only the first step in the supply chain.

“The minerals extracted at the mine must be processed into the advanced, high-quality materials and products that the European manufacturing industry demands,” he explained. “For Sweden and other European countries, the main bottleneck is not upstream, at the mining. It is downstream, at the processing and manufacturing of goods embedded with rare earth elements.”

These materials and products – which are needed for Europe’s “green transition” – are what the EU deems “critical”, he said, adding that “the Chinese dominance becomes greater the farther down the supply chain you get”. He also noted how rare earth magnets are commonly used in electric-vehicle motors, wind turbines and computer hard drives.

Can the new deposit reduce Europe’s reliance on rare earths from China?

Nicolas at the French Institute of International Relations said that the discovery of such a massive deposit of rare earth elements in Europe “may turn out to be a game changer” because it may help the EU further reduce its dependence on Chinese imports.

“It is worth stressing here that the point is not about decoupling from China, but simply about mitigating what is perceived as a situation of over-dependence and a source of vulnerability,” she said.

Echoing Nicholas, Natixis’ Garcia-Herrero said that “this is not decoupling, but successful diversification”, as the European Union is already reducing its dependence on China by reshuffling parts of its value chain.

However, Andersson’s perspective is that there is “clearly political will” in Europe for the selective or partial decoupling from China in the technology sector.

“The EU wants to maintain strong and healthy trade relations with China, but it is also concerned about the risks of over-reliance on Chinese technologies in some sectors, as well as about the lack of reciprocity in trade and investment practices,” he added.

But as Nicholas points out, it would take at least 10 to 15 years before the rare earths mined in Sweden hit the market.

“Exploration of the site will not start for years, even if permits are delivered very fast,” she explained. “Moreover, the whole project is likely to face resistance due to its potentially harmful environmental and social impact.”