With strong financial ties to China, Australia is bracing for impact as the country’s deepening economic woes threaten its trading partners.

Growth has stalled in China, as has foreign investment, at the same time as a property crisis worsens, with developers Evergrande and Country Garden facing severe financial difficulties.

Youth unemployment had surged to 21.3% before Beijing abruptly suspended the data series, setting alarm bells ringing.

Australia was planning to profit from China’s pandemic recovery, before signs emerged that all was not well with the major iron ore customer and sender of tourists.

A sharp downturn in China would depress economic growth in Australia, through lower exports and investment, notably in the resources and tourism markets.

Unemployment would rise, and the surging company and personal tax revenues currently swelling the Albanese government’s budget would dramatically slow.

The pursuit of future surpluses, delivered in 2022-23 for the first time in 15 years, would also become a much more difficult assignment.

Veteran Perth-based mining analyst Peter Strachan says that, after decades of strong economic growth, a sharp economic pullback in China might be due.

“I can’t see why China, after having 30 years of extraordinary growth, won’t come up against some sort of economic or social crisis,” Strachan says.

“This could be it.”

Deteriorating iron ore prices

China is Australia’s largest trading partner, accounting for nearly one-third of its overseas trade, according to government data, underpinned by significant amounts of iron ore, coal, gas and numerous minerals.

Strachan says China’s slowdown will have an immediate impact on Australia’s exports and commodity prices, given its outsized role as a buyer.

“If the Chinese are buying less, they’ll be building less, and therefore buying less iron ore,” he says.

“As the economy slows, they’ll be buying less liquefied natural gas from us as well. I suspect we’re not going to be rushed off our feet supplying iron ore or liquified natural gas to China over the next 12 months.”

Iron ore prices have already fallen heavily from high prices struck over the past two years amid a global slowdown.

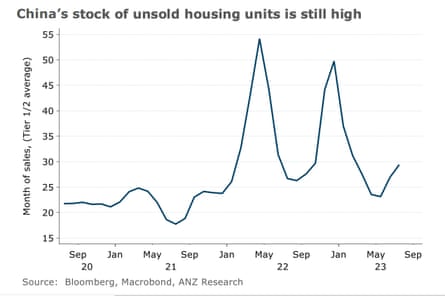

“China’s beleaguered property sector shows no signs of improving,” says ANZ, noting the sector consumes more than one-third of the country’s steel output.

“The subsequent weakness in steel demand is likely to put downward pressure on iron ore prices.”

The impact of a mining slowdown on Australia is hotly debated, given there is a high foreign ownership component of large miners and profits don’t necessarily fuel other parts of the economy.

While resources towns can become more affordable during a mining pullback, deteriorating iron ore prices would, however, lead to a reduced tax take. There are also numerous companies that are set up to service miners.

The Western Australia government’s iron ore royalty income also falls when prices and export volumes pull back, which reverberates around the country due to the way GST revenue is shared between the states.

Chinese tourism cratering

As pandemic travel doors reopened, there were hopes China’s high-spending tourists would flood back to Australia – but it turned out to be a trickle.

More people came for short-term stays from the island country of Singapore in 2022-23 than from all of China, according to the Bureau of Statistics.

after newsletter promotion

The heavily reduced number of Chinese visitors, representing just 17% of pre-pandemic levels, has been linked to a shortage of flights, high air fares and a government ban on group tours; the latter only having just been lifted after Beijing eased travel restrictions.

Grant Wilckens, chief executive of holiday park owner G’day Group, says the property downturn came at a difficult time.

“They’re a massive population base, they were here in droves, and now this is another reason for them not to come, or put off their trip,” Wilckens says.

“The property downtown in China is certainly a concern.”

He says Chinese traveller numbers are down about 60% from pre-pandemic levels at his operations.

Internal travel and overseas tourist numbers are closely linked to wider financial factors, with any weakness in an economy typically leading to a drop in travel. This then affects employment numbers in the tourism sector.

The international student market is similarly affected.

Chinese travel has also been hampered by a series of product bans and tariffs the country started to impose on Australia in late 2020 after bilateral relations deteriorated.

Wilckens says a further easing of trade restrictions could help generate more flights to and from China.

“That actually puts freight into the bellies of aircraft, creating more demand for flights in and out of Australia, with tourists on them,” he says.

A weakening Aussie dollar

The Australian dollar is heavily influenced by iron ore price movements, which means that price weakness in the resources sector usually depresses the local currency, which is seen as a commodity currency and proxy for the Chinese economy.

Last week, the Australian dollar sank to US63.63c, the lowest since last November. The plunge against the greenback is starting to resemble levels last hit in the global financial crisis.

Carlo Pruscino, senior sales trader at CMC Markets, says given currencies act as a barometer of health for their economies, a sustained slowdown in China would probably negatively affect the yuan and Australian dollar.

“If the Chinese slowdown continues, then it could lead to a sustained drop in demand for Australian exports, meaning decreased revenues for Australia,” says Pruscino.

“Offshore investors could shy away from the Australian dollar in favour of less export-dependent countries.

A weaker Australian dollar can help exporters, because their goods are less expensive than rival products from countries with stronger currencies. It’s also a drawcard for international tourists, who benefit from exchange rates.

On the flip side, importers and Australians heading abroad have less purchasing power.

China could still try to stimulate itself out of its economic problems, which would typically lift resource prices, along with the Australian dollar, although some economists believe that runs the risk of Beijing taking on too much debt.

Its trusted model of investing in roads, homes, factories and bridges now makes less sense given how much infrastructure is already underused or vacant.

So far Chinese officials have announced numerous small measures, leaving the market underwhelmed, and iron ore prices and the Australian dollar depressed.