The developer cancelled four meetings for two classes of its creditors in Hong Kong and the Cayman Islands set for September 26, according to an exchange filing late on Friday. Two meetings on September 25 for another group of bondholders in Hong Kong and the British Virgin Islands were also halted.

“The sales of the group have not been as expected,” it said. “Based on the current situation and consultations with its advisers and creditors, the company considers it necessary to reassess the terms of the proposed restructuring to meet the objective situation and the demand of the creditors.”

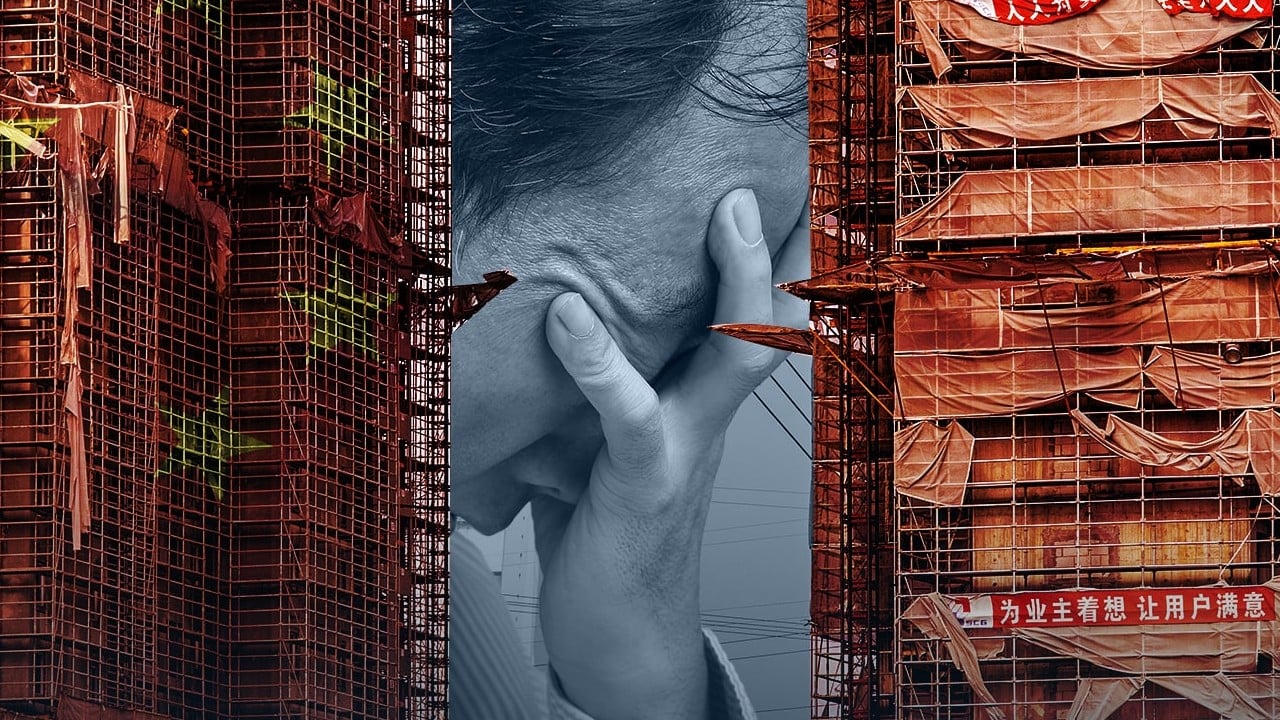

Evergrande is seeking to reorganise US$20 billion of defaulted debt and claims in the largest ongoing workout by a Chinese company. The developer, which had 2.4 trillion yuan (US$327 billion) in total liabilities on June 30, offered new bonds, convertible debt and stakes in its property management and car-making units to appease creditors.

How Hui Ka-yan plans to rescue Evergrande from China’s corporate graveyard

How Hui Ka-yan plans to rescue Evergrande from China’s corporate graveyard

Money managers said while Beijing is easing mortgages rules and financing costs, its policy actions have done little to address the credit crunch in the US$2.6 trillion domestic housing market. Since kicking off its industry-crippling “three red lines” rules in August 2020, the nation’s biggest private developers have succumbed as home sales tanked, cash flows dwindled and creditors balked.

Advertisement

Under its restructuring timetable, Evergrande aims to lock creditors into full agreement by October 1 and conclude the process by December 15. The company last month filed for Chapter 15 protection in the US Bankruptcy Court to give its workout a global effect and recognition.

Based in its late-April filing, Evergrande said creditors holding 77 per cent of US$14.2 billion of class A debt have acceded to its restructuring terms, exceeding the required 75 per cent threshold, while investors holding 91 per cent of US$5.23 billion bonds issued by its unit Scenic Journey have also consented.

Advertisement

It was still short of the threshold in two other classes of debt. Holders of class C claims related to US$13 billion of those obligations, delivered only 30 per cent support, it said. Only 64 per cent acceded in another set of claim against a Hong Kong unit that guaranteed some of the bonds.

Advertisement