This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

The deteriorating global outlook for growth

South Korea ‘will not fight back’ against US tariffs

Why Jamie Dimon is right about meetings

Threats to global growth are rising as the US-driven trade shock crushes confidence and slams financial markets, according to research for the Financial Times. The findings come ahead of key meetings of economic policymakers in Washington this week.

What the research found: Confidence indicators have slumped sharply while financial market conditions have deteriorated, according to the Brookings-FT Tracking Indexes for the Global Economic Recovery. The deterioration in the global outlook is a marked contrast to the relatively firm start to the year. The confidence numbers for the US are particularly stark, showing the lowest confidence levels since the index began, alongside a sharp deterioration in financial market conditions. Confidence levels in China and Germany also hovered at depressed levels.

What analysts said: Eswar Prasad, a senior fellow at the Brookings Institution, said it would be “premature” to forecast a worldwide recession but warned that the breakdown of global trade and higher policy uncertainty would markedly suppress growth. “We have seen this huge shock,” said Prasad. “Every open economy that relies on trade is going to get squeezed, and on top of that you will have [negative] confidence effects.”

Looking ahead: The findings come as economic policymakers and finance ministers from around the world gather in Washington for the first set of IMF/World Bank spring meetings since Donald Trump’s inauguration as US president. Kristalina Georgieva, the managing director of the IMF, warned last week the fund was preparing to cut growth forecasts, as “financial markets volatility is up” and “trade policy uncertainty is literally off the charts”.

The meetings in Washington come as policymakers await further clarity over the Trump administration’s stance towards the Bretton Woods institutions. The White House has launched a review into the US’s role and support for international institutions — and Treasury secretary Scott Bessent is expected to address the new administration’s policies on the IMF and World Bank in a discussion on Wednesday. Read the full story.

Here’s what else I’m keeping tabs on today:

Monetary policy: The People’s Bank of China makes its loan prime rate announcement.

Global economy: The IMF and World Bank spring meetings begin in Washington, concluding on Saturday.

US-India relations: Vice-president JD Vance begins a four-day visit to India for talks on trade and geopolitical ties. (Associated Press)

Five more top stories

1. South Korea “will not fight back” against US tariffs, its acting president has said, citing the country’s historical debt to Washington ahead of trade talks with the Trump administration set to begin this week. Han Duck-soo told the FT that “the role of the US was huge in making Korea what it is now”. Read the full interview.

2. The Israeli military has admitted to “professional failures” and said it would sack an officer, after an incident in which its forces killed 15 unarmed emergency workers in southern Gaza last month. The Israel Defense Forces has had to change multiple elements of its account of what happened after video emerged contradicting its earlier versions.

3. Chinese tech groups are leading a multibillion-dollar campaign to help traditional exporters switch to domestic sales amid an escalating trade war with the US. Ecommerce giants Alibaba, JD.com and Pinduoduo are among the internet groups spearheading the national movement to cushion China’s economy from Trump’s tariffs.

4. The Trump administration has floated abolishing the US state department agency in charge of policy in Africa and closing many embassies on the continent in a draft executive order that has been decried as a “hoax” by secretary of state Marco Rubio. Here are the proposals in the draft document.

More US news: A Republican member of the Senate committee that oversees the Federal Reserve has criticised Trump’s attacks on Jay Powell, saying no president has the authority to fire the head of the US central bank.

5. Ukraine’s President Volodymyr Zelenskyy said yesterday that Russia had launched fresh attacks despite President Vladimir Putin ordering his army to suspend combat operations in Ukraine over the Easter holiday. “In practice, either Putin does not have full control over his army, or the situation proves that in Russia, they have no intention of making a genuine move towards ending the war,” Zelenskyy wrote on social media. Read the full story.

News in-depth

China’s latest export controls on rare earth minerals could cause shutdowns in automotive production, with stockpiles of essential magnets set to run out within months if Beijing fully chokes off exports. Traders and executives warned that companies had been caught off guard and would be racing to find alternative supplies to avoid major disruption.

We’re also reading . . .

Trump’s tariffs hit Chinatown: Chinese American small businesses in New York are struggling to cope with the worst ever US-China trade war.

Slop world: The last bits of fellowship and ingenuity on the internet are being swept away by a tide of so-called artificial intelligence, writes Jacob Silverman.

Arctic security: In spite of rising diplomatic tensions, the most immediate geopolitical risk is not military conflict, writes Martin Sandbu.

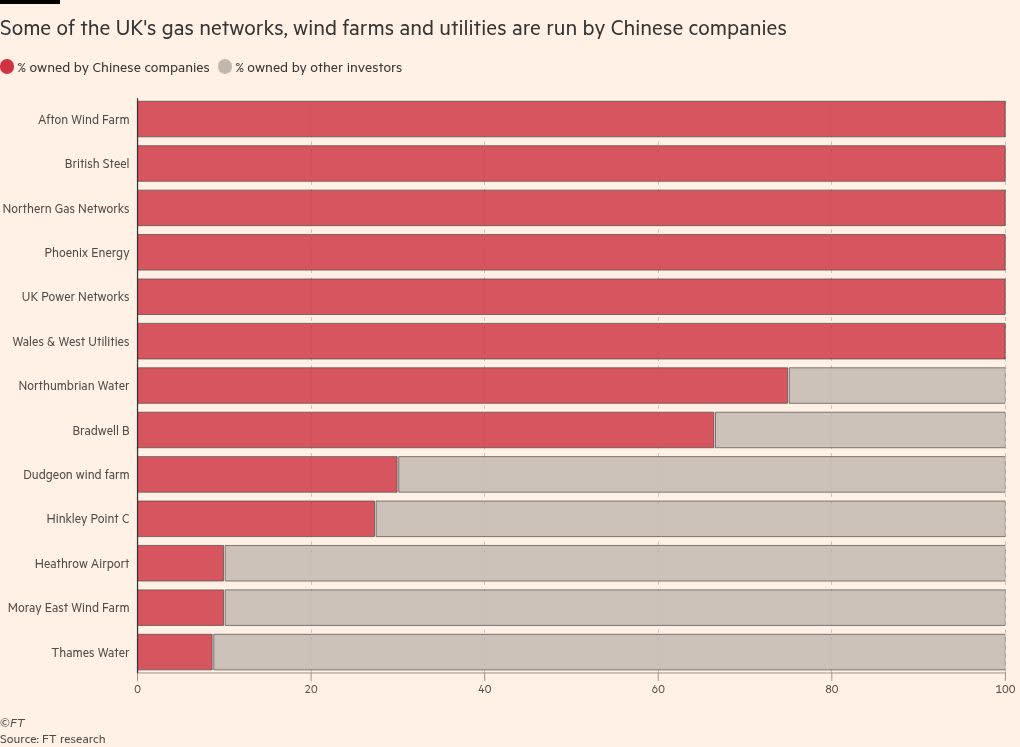

Chart of the day

The UK government’s decision to seize control of British Steel from Chinese owner Jingye has led to demands for greater scrutiny of China’s investments in the country. China has poured more than $100bn into the UK since 2000, while energy alone accounts for almost a fifth of all major Chinese investments since 2005.

Take a break from the news

Jamie Dimon’s annual letter to shareholders struck a nerve with his call to “kill” meetings. Plenty of workers share the JPMorgan chief executive’s frustration with endless discussion, writes Emma Jacobs.