Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Boeing is prepared to look for alternative buyers for its planes destined for Chinese airlines as the US aircraft maker deals with the fallout from President Donald Trump’s trade war, its chief executive has said.

Kelly Ortberg on Wednesday confirmed Beijing had stopped taking deliveries of its aircraft due to the tariffs between the two countries. The US aerospace and defence group is America’s largest exporter and Beijing’s retaliatory tariffs on US goods have made Boeing’s jets significantly more expensive for Chinese airline customers.

Ortberg said Boeing was taking a “very straight forward approach” to the situation. It could look to remarket those planes already in production while redirecting ones not yet built to other customers if needed.

The company had “many customers who want near-term deliveries”, said Ortberg, warning that Boeing was “not going to continue to build aeroplanes for customers who are not going to take them”.

“I am not going to let this derail the recovery of our company,” he said in an earlier interview with CNBC.

Boeing has taken back two planes that were in China due for delivery and was in the process of bringing back a third, Ortberg told analysts on an earnings call. It had about 50 aeroplanes scheduled to be delivered to China over the remainder of the year, including 41 already built or in the process of being built.

Boeing is also facing additional costs from Trump’s baseline 10 per cent duties on imports into the US, notably on crucial aircraft components coming from Japan and Italy.

Ron Epstein, Bank of America analyst, said in a note that despite the uncertainty surrounding China-bound 737 deliveries, “we believe Boeing will have no difficulty reallocating these aircraft to other airlines requiring additional capacity, with India emerging as a likely candidate”.

The uncertainty from the trade war overshadowed better than expected first-quarter results from the US aerospace and defence group.

It reported a smaller than expected first-quarter loss after an increase in aircraft deliveries, and confirmed its forecast of positive free cash flow for the latter part of the year thanks to strong commercial aircraft deliveries.

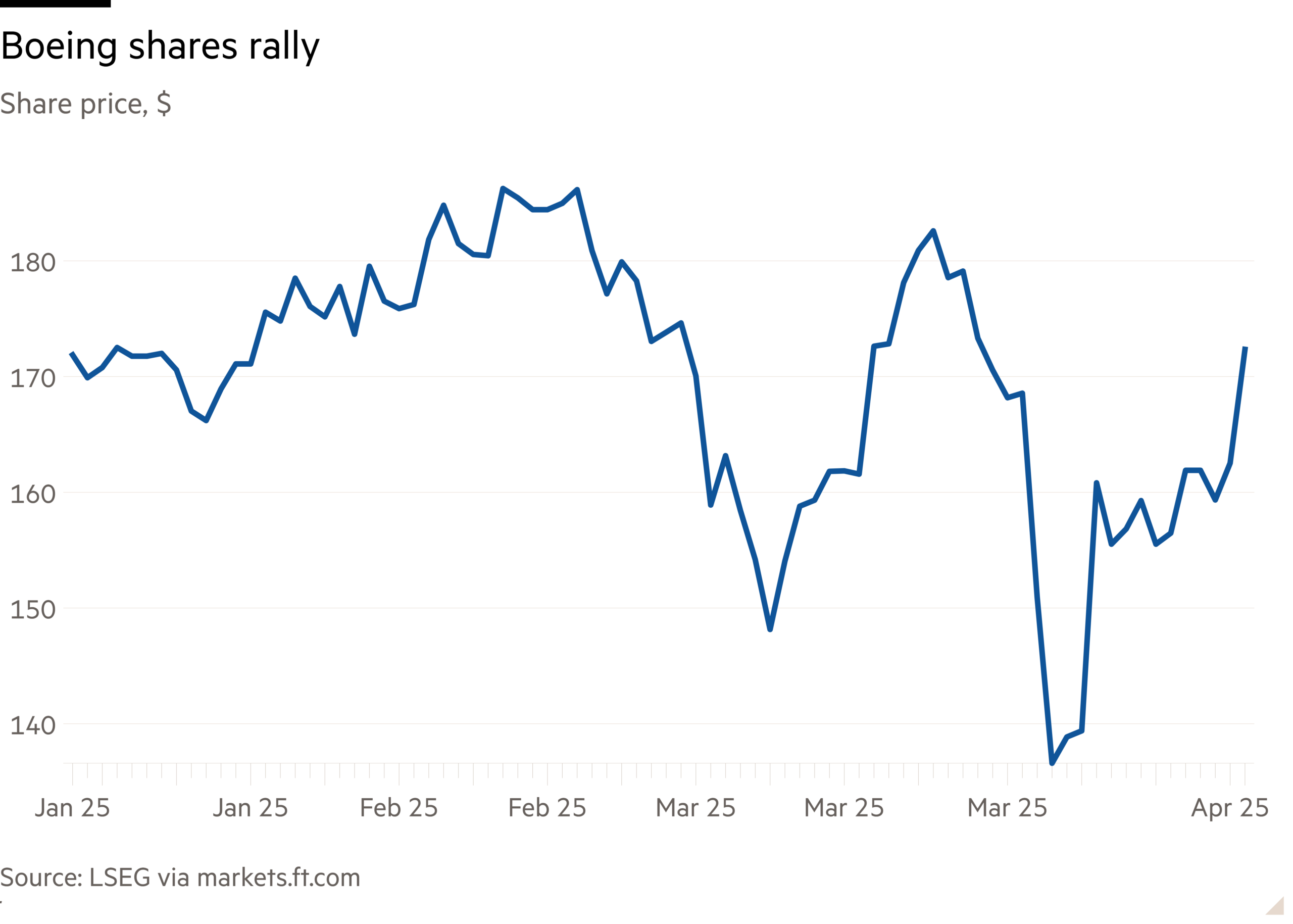

Boeing shares jumped almost 9 per cent, later trading 5.7 per cent higher in early-afternoon in New York.

For the first quarter, Boeing incurred a net loss of $31mn, significantly lower than the $355mn loss it reported in the same period last year. Revenues in the quarter rose 18 per cent to $19.5bn amid higher aircraft deliveries. It had negative free cash flow of $2.3bn, compared with a negative $3.9bn in the same period last year.

On an adjusted basis, Boeing reported a loss per share in the quarter of $0.49, down from a loss of $1.13 per share a year earlier and less than the loss of $1.24 per share expected by analysts. The results only reflected tariffs enacted as of March 31, Boeing said.

Ortberg, who was brought in last August to turn around the group in the aftermath of a mid-air accident involving one of its 737 Max planes in January 2024, said the company was “moving in the right direction and making progress”.

“We’re building higher-quality aeroplanes and delivering them with more predictability,” he said in a letter to staff on Wednesday, in which he described 2025 as Boeing’s “turnaround year”.

The company on Wednesday reaffirmed plans to reach a target of producing 38 of its best-selling 737 Max planes a month this year. It plans to ask the Federal Aviation Administration, which capped the aircraft’s output at 38 following the incident on an Alaska Airlines flight last January, to move to a rate of 42 a month later this year. Boeing, said Ortberg, had reduced so-called travelled work on the 737 production line — where work is done out of sequence.

It is also stabilising production of its 787 jets at five a month, with plans to increase to seven a month this year.

Boeing delivered 130 planes in the first three months of the year — including 104 of the 737 Max — up from 83 deliveries in the same period of 2024.

Boeing on Tuesday announced a plan to sell parts of its digital aviation unit to private equity group Thoma Bravo for $10.6bn to shore up its finances. Last year, it raised $24bn in equity and said it would cut 17,000 jobs.

Ortberg said Boeing was considering a “couple more steps” with regards to streamlining its portfolio.

Additional reporting by Claire Bushey in Chicago