Paul Chan, the top finance official of Hong Kong, traveled to Paris, London, Frankfurt and Berlin last September to lure foreign investors. Last month he abolished taxes on foreigners’ purchases of Hong Kong real estate. And he is soon set to host an international art show, as well as conferences for big money funds and advisers to wealthy families. Mr. Chan’s brisk work pace represents an attempt to shore up Hong Kong’s role and image as the financial hub of Asia. But that effort is now colliding with a move…

Tag: Stocks and Bonds

China Sets Economic Growth Target of About 5%

China’s top leaders on Tuesday set an ambitious target for growth as its economy is laboring under a steep slide in the housing market, consumer malaise and investor wariness. Premier Li Qiang, the country’s No. 2 official after Xi Jinping, said in his report to the annual session of the legislature that the government would seek economic growth of around 5 percent. That is the same target that China’s leadership set for last year, when official statistics ended up showing that the country’s gross domestic product grew 5.2 percent. Some…

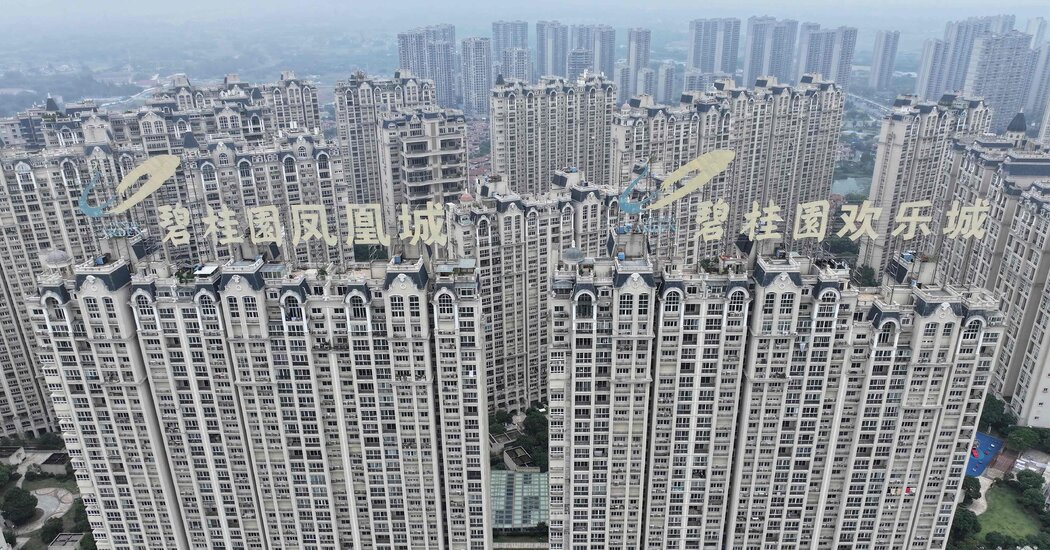

China’s Country Garden Faces Winding Up Petition In Hong Kong

Country Garden, China’s largest real estate developer as recently as 2022, said on Wednesday that a creditor had asked a Hong Kong court to liquidate its operations and pay off lenders, in the latest sign that China’s housing crisis continues unabated. Ever Credit Ltd., a Hong Kong lender, is petitioning the city’s High Court to shut down Country Garden. The court filing involves Country Garden’s failure to repay a loan of $204 million plus interest owed to Ever Credit, the real estate developer told the Hong Kong stock market. Ever…

China’s Investors Are Losing Faith in Its Markets and Economy

Like many Chinese people, Jacky hoped that he could make enough money investing in China’s stock markets to help pay for an apartment in a big city. But in 2015 he lost $30,000, and in 2021 he lost $80,000. After that, he shut down his trading account and started investing in Chinese funds that track stocks in the United States. It’s a perilous time for investors in China. Their main vehicle, so-called A shares of Chinese companies, fell more than 11 percent in 2023 and have continued their losses this…

How China Censors Critics of the Economy

China’s top intelligence agency issued an ominous warning last month about an emerging threat to the country’s national security: Chinese people who criticize the economy. In a series of posts on its official WeChat account, the Ministry of State Security implored citizens to grasp President Xi Jinping’s economic vision and not be swayed by those who sought to “denigrate China’s economy” through “false narratives.” To combat this risk, the ministry said, security agencies will focus on “strengthening economic propaganda and public opinion guidance.” China is intensifying its crackdown while struggling…

After China Evergrande, Real Estate Crisis ‘Has Not Touched Bottom’

The unwavering belief of Chinese home buyers that real estate was a can’t-lose investment propelled the country’s property sector to become the backbone of its economy. But over the last two years, as firms crumbled under the weight of massive debts and sales of new homes plunged, Chinese consumers have demonstrated an equally unshakable belief: Real estate has become a losing investment. This sharp loss of faith in property, the main store of wealth for many Chinese families, is a growing problem for Chinese policymakers who are pulling out all…

Real Estate Giant China Evergrande Will Be Liquidated

Months after China Evergrande ran out of cash and defaulted in 2021, investors around the world scooped up the property developer’s discounted I.O.U.’s, betting that the Chinese government would eventually step in to bail it out. On Monday it became clear just how misguided that bet was. After two years in limbo, Evergrande was ordered by a court in Hong Kong to liquidate, a move that will set off a race by lawyers to find and grab anything belonging to Evergrande that can be sold. The order is also likely…

As China’s Markets Stumble, Japan Rises Toward Record

There’s a shift underway in Asia that’s reverberating through global financial markets. Japan’s stock market, overlooked by investors for decades, is making a furious comeback. The benchmark Nikkei 225 index is edging closer to the record it set on Dec. 29, 1989, which effectively marked the peak of Japan’s economic ascendancy before a collapse that led to decades of low growth. China, long an impossible-to-ignore market, has been spiraling downward. Stocks in China recently touched lows not seen since a rout in 2015, and Hong Kong’s Hang Seng Index was…

Jack Ma Doubles Down on Alibaba

Tsai has bought about $151 million worth of Alibaba’s U.S.-traded shares in the fourth quarter, via his Blue Pool Management family investment vehicle, a securities filing confirmed on Tuesday. Ma, who stepped down as the company’s executive chairman in 2019 but remains a major shareholder, bought $50 million worth of Hong Kong-traded stock in the quarter, according to a person with knowledge of the matter. (Both men already hold sizable amounts of Alibaba stock.) The purchase sizes aren’t huge — Alibaba’s market capitalization is about $171 billion — but given…

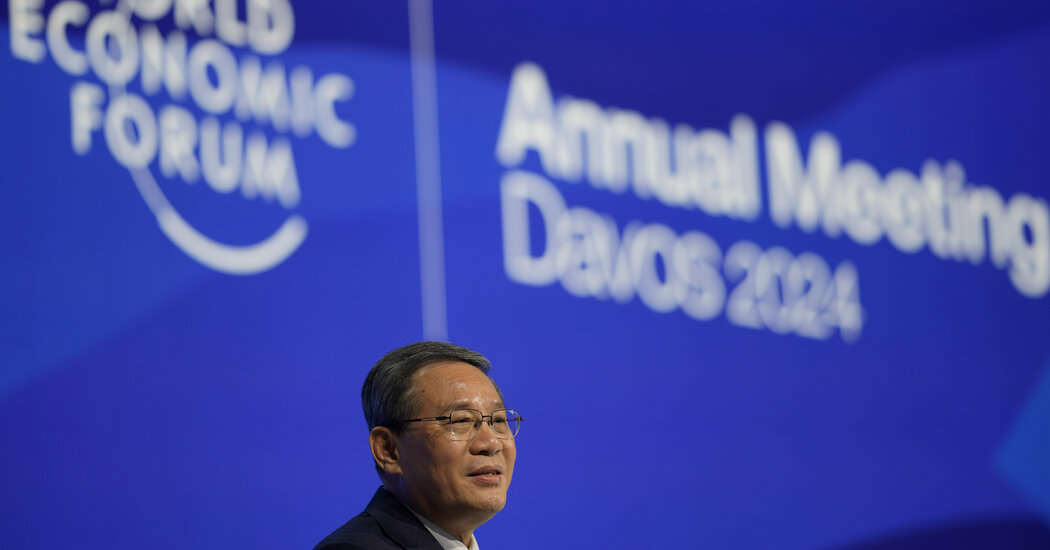

Hong Kong Stocks Sink 4 Percent as China’s Economy Scares Investors

China’s No. 2 leader, Li Qiang, traveled to Switzerland with a message for the titans of the business world gathered for the World Economic Forum. “Choosing the Chinese market is not a risk, but an opportunity,” Mr. Li, China’s premier, told an audience in Davos, Switzerland on Tuesday. But there’s a different sentiment about China playing out in the stock market and it’s not so optimistic. The worries over China’s economy have been visible for months in Hong Kong, where stocks plunged 14 percent last year. The new year hasn’t…